a Banking App" />

a Banking App" /> a Banking App" />

a Banking App" />

Do you remember the times when you needed to wait in line at a bank to open an account?

Luckily, the times are far gone.

Now you don’t need to leave your home or even your bed for such tasks. A smartphone and a banking application are all you need.

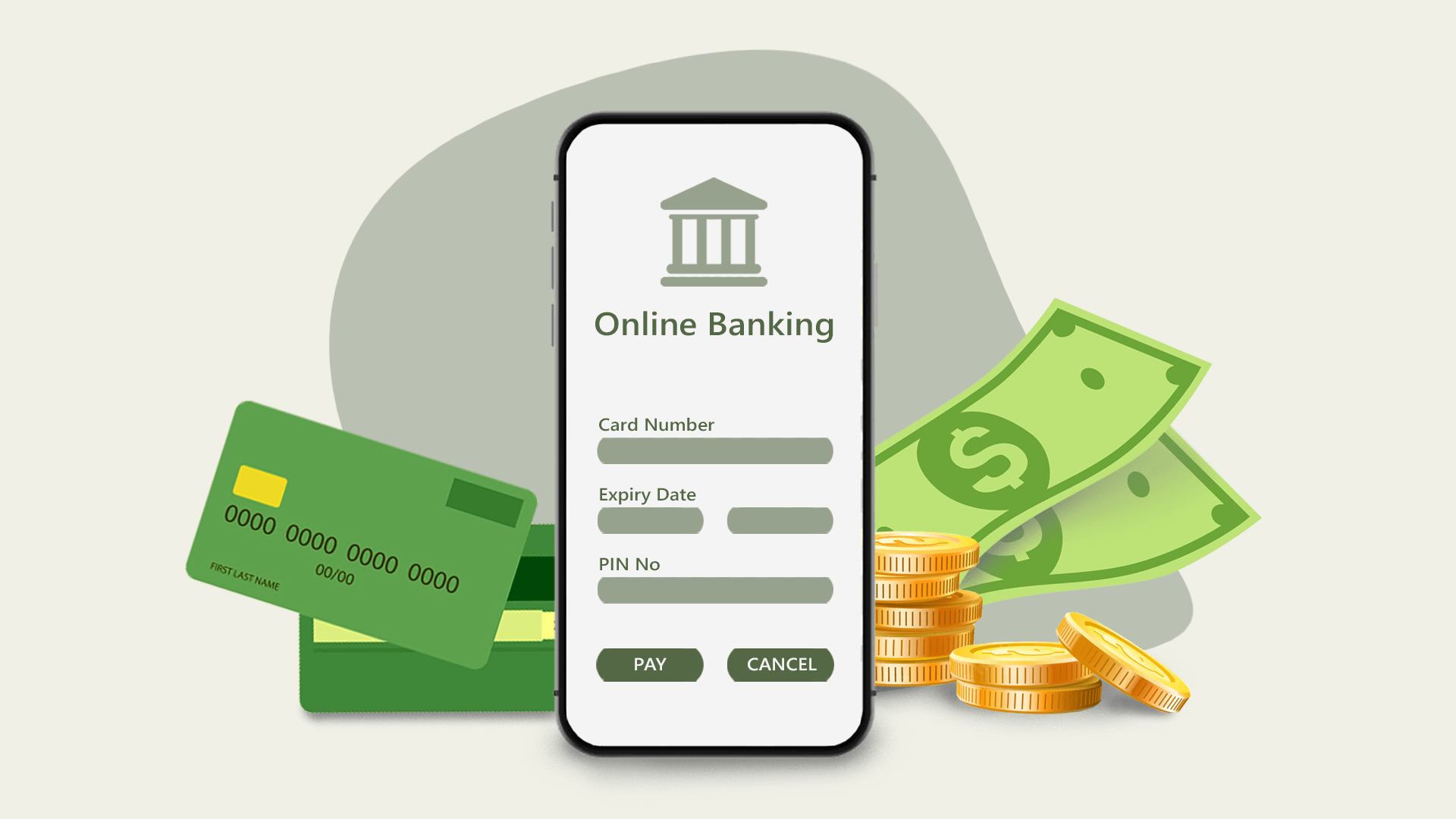

In 2020, 1.9 billion people worldwide actively used online banking services. The number is projected to reach 3.6 billion by 2024.

Let’s explore how to create a banking application.

Before we move on, take a sneak peek into what’s waiting in the guide:

Are you in? Read on.

The growth of smartphone users encouraged companies to actively explore the new medium. Even banking organizations couldn’t stay aside and started creating banking apps.

For the past decade, mobile banking has been actively developing and morphing from balance-checking solutions into the whole banks in your pockets.

A banking app is a mobile application where users can access their bank account, complete transactions right from their mobile devices, check balance, view payment history, etc. The main goal of such applications is to provide key banking services right on mobile devices.

Today, three main types of banking apps are identified:

Billions of people all over the world are active users of banking applications.

Bank of America can boast the biggest number of users – 30 million active users of its mobile banking app.

Around 77% of Millenials are ready to switch to digital-only banks in the USA. The number among older generations is a little bit lower – at 66%. Around 95% of Gen Z are already using mobile banking solutions.

a Banking App: Ultimate Guide from Experts 1" />

a Banking App: Ultimate Guide from Experts 1" />

Banks without a dedicated mobile application are at the threat of being thrown out of the business in the very near future. Clients love such applications because of the provided convenience and instant access to banking services.

Let’s review some of the benefits that banking apps offer to businesses and users in more detail.

For millions of people all over the world, mobile banking apps have become the main way to control their finances. Such applications offer a lot of advantages. According to Statista, users use mobile banking applications to

We can also add a few other benefits of banking applications for users:

The images below represent a percentage ratio of key reasons to use banking apps among clients in the USA.

JavaScript chart by amCharts 3.21.15Reasons for using mobile banking apps in the USA

View recent transactions

Make bill payments

Contact customer service

Open a new account

Share of respondents

JavaScript chart by amCharts 3.21.15There should be a balance between advantages for users and for businesses. It’s not enough to know how to create a banking app. You need to understand what business benefits you want to get.

There is nothing that can stop the growth of mobile banking's popularity. The provided convenience will help you attract more clients and significantly expand the client base.

Moving a part of or even all operations online significantly reduces operating costs. You don’t need to open a banking branch or a few in every city where you have clients.

Clients can access banking services from any location in the world. They can quickly make payments, get 24/7 customer support, check their balance, and much more. All of this combined creates a better customer experience, which results in higher customer loyalty.

Banks save a lot of money when they reduce the number of offices, staff, and branches. Moving online, you can significantly increase ROI and optimize expenses.

Mobile applications can be powered by Artificial Intelligence and Machine Learning. The information the systems collect can be used to create a highly personalized experience for mobile users. The received information will also help to create users’ behavior models to identify how to create a banking application further.

Creation of a mobile application will open up a new marketing channel. You can use the collected information to create special offers, promote other services, and notify customers about any changes in your business.

Banking mobile app development can be broken up into eleven main steps:

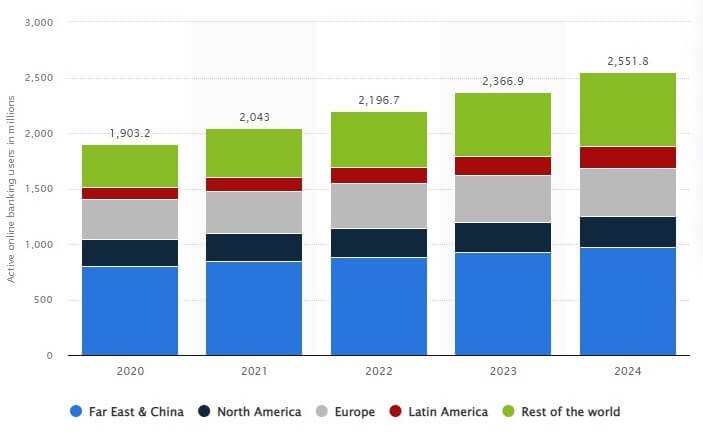

Usually, app development is divided into two big stages: discovery and development.

1. Discovery stage – during this stage a common understanding of the future product is created between the product owner and app development company.

2. Development stage – during this stage the app is created based on the data delivered during the discovery phase.

Let’s find out how to create a banking app in more detail.

Machine Learning: 16.67%

AI-powered chatbots: 16.67%

Biometric security: 16.67%

Mobile-only banking: 16.67%

AI fraud prevention: 16.67%

Voice control: 16.67%

JavaScript chart by amCharts 3.21.15After you decide to build a banking app, you can’t just jump right to the development. There are a lot of steps that precede it.

Market research will help you understand how to create a banking app and successfully deliver it to the highly competitive market.

The main idea is to explore the demand and the offerings from your future competitors. You need to understand what banking apps users are accustomed to, what apps they use, and which features those apps are offering. It will help you to map out the journey and draft plans for the future application.

The best decision you can make is to create an app that is unique and doesn’t copycat the functionality of already existing and popular solutions. Innovations are one of the ways to make sure that a business stands out from the crowd and offers some really unique features.

The innovations mentioned below will be riding the mobile banking game in the foreseeable future:

Who is your target audience?

You need to have an answer to the question before you decide how to create a banking application.

Try to find out as much about your target audience as you can. Identify their age, location, how they prefer to spend their free time, and even how techy they are.

Aside from general questions, you’ll also need to answer some banking-specific questions: how many transactions they make every month, whether they have regular payments or not, how often they get in touch with the support service, and so on.

For example, the younger generation between 18 to 24 years old mostly uses mobile banking applications to transfer small amounts of money. A more mature audience from 25 to 70 years old uses such apps to pay utility bills, control cash flow, and make transactions of larger amounts.

| View account balance | Total | Gen Z | Millennials | Gen X | Boomers |

| View account balance | 86.5% | 86% | 89.5% | 86.5% | 78% |

| View account statements | 68% | 62% | 73.5% | 67% | 61.5% |

| Transfer money between bank accounts | 64% | 65.5% | 71.5% | 60.5% | 50% |

| Deposit checks | 59.5% | 58% | 66% | 54% | 53.5% |

| Pay bills | 49% | 45.5% | 53% | 50% | 40.5% |

| Check credit score | 32% | 28.5% | 56.5% | 30% | 20% |

| Use peer-to-peer payment | 24% | 20% | 31% | 21.5% | 14.5% |

| Use online chat to ask a question | 16.5% | 18% | 27.5% | 13% | 12.5% |

| Create and track a budget | 13.5% | 25% | 17.5% | 9% | 4% |

| View a forecast of monthly spending | 13% | 17% | 18% | 9.5% | 4.5% |

| Create a savings goal and track progress | 12% | 21.5% | 18% | 5.5% | 2% |

| Open a new bank account | 9.5% | 11.5% | 12% | 7% | 5.5% |

Knowing all this information you’ll be able to better understand which features to develop. For example, if your target audience makes a lot of regular transactions, consider adding the functionality that would allow them to automate such payments.

Identifying and investigating competitors is the next stage of research. It will help you understand the strong and weak sides of the competition, what basic and advanced features their apps are offering, and what they are offering to clients in terms of services.

The collected information is vital to deciding how to create a banking application. Your goal here is to make sure that your app is better than that of competitors. While the success highly depends on the features, the core value brings the banking services you are offering.

Every application is unique. Even companies, providing the same services, can implement different functionality. The final feature set will depend on the services provided, the target audience, the market for which you develop an app, and so on.

In this part of the article, we review some of the most common features that the vast majority of banking apps have.